Secure Your Financial Future with IUL

(Index Universal Life Insurance)

Discover how Index Universal Life Insurance (IUL) can help you secure your retirement, save for future big purchases, plan for your children’s college, build an emergency fund, and more!

Download our FREE comprehensive e-book today and learn the advantages of IUL products.

" The journey to universal life requires persistence and dedication. Stay committed by regularly reviewing your progress and adjusting your plan as needed. Remember, every step forward is a step closer to financial freedom "

Download Now

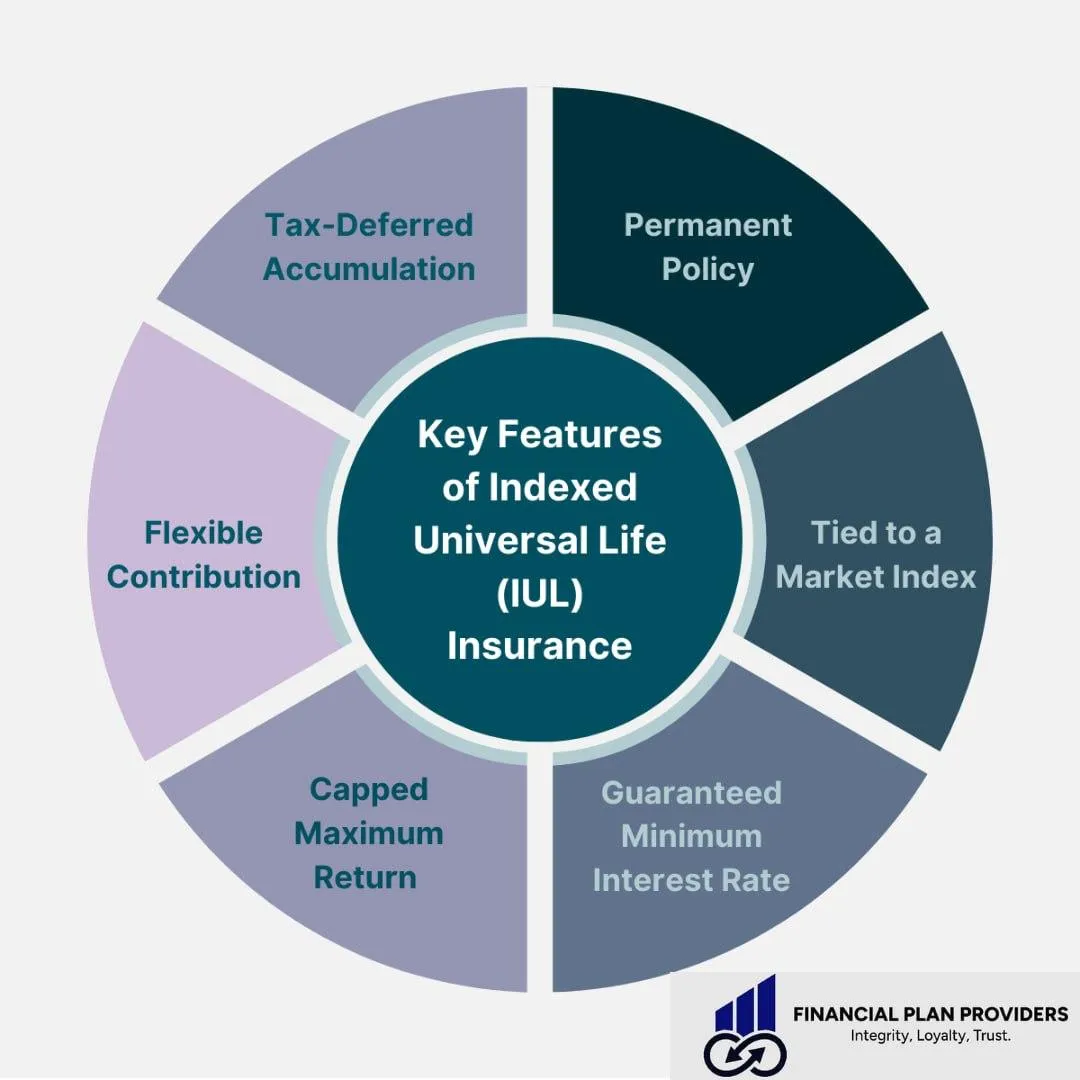

The Main Features

Maximize your time to build your desired wealth with IUL.

Want to learn more?

Insights you will gain from our IUL

{Leaving a Legacy}

IUL policies enable individuals to leave a financial legacy by providing a tax-free death benefit to beneficiaries. This allows for the transfer of wealth to the next generation or charitable organizations without the burden of taxes.

{Long-Term Care}

IUL policies can include riders that specifically cover long-term care expenses, allowing policyholders to access their death benefits early to pay for such care if needed. This feature provides financial support for long-term health needs without depleting other assets.

{Saving for the future}

IUL policies support long-term savings by offering the potential for tax-free

growth of cash value, which can be accessed in the future for any purpose, from retirement to major life events. This flexibility makes them an effective tool for building substantial savings over time.

{Retirement Planning}

(IUL) policies are designed to accumulate cash value that can be accessed during retirement, providing a consistent source of income to supplement traditional retirement funds.

{Saving for big purchases}

IUL policies allow you to grow a financial reserve through cash value accumulation, which can be used for significant future expenses such as buying a home or car.

{College planning}

IUL policies can be strategically used for college planning by accumulating cash value that parents can later withdraw to cover educational expenses. This approach offers a flexible and tax-advantaged way to save for a child's higher education.

Financial Plan Providers LLC

Financial Plan Providers LLC Advisors is a free financial advisor and wealth management firm located in Houston, Texas. For years we’ve been serving the financial needs of individuals, families, and businesses from around the world. When we take on new clients, they become part of our extended family, and in the past years we’ve developed multi-generational relationships with many of them.

Our primary goal is to simplify your financial life. Our Certified Financial Planner professionals and advisors combine investment management and holistic financial planning to provide total wealth management for our clients. Together, we’ll construct a financial game plan and investment strategy to meet your goals, and give you greater confidence in your future.

Office: 2600 S Gessner Rd, Suite 420-1,Houston, Texas,77380

(4th floor)

Email:[email protected]

© 2024 Financial Plan Providers LLC. All Rights Reserved.

Facebook

Instagram

LinkedIn

Youtube

Website